No Bahamas cruises this weekend!

THIS WEEKEND will be an unhappy one for many cruisers. They will be traveling to destinations they didn’t intend—or want—to visit, thanks to Hurricane Irene. Some cruisers will be able to cancel with no penalties, while perhaps the majority will have to put up with a cruise to not-where-they-wanted.

Now is a good time for anyone planning a cruise to consider the need for cruise insurance. Because of more than just Hurricane Irene.

This week has been a bizarre series of natural events no one could forecast. Just as last summer–who could have predicted that the eruption of an Icelandic volcano would make air travel to Northern Europe impossible for lengthy periods. (Which also made it impossible for countless cruise passengers to leave port on time.)

The 5.8 earthquake that originated in Virginia was felt from Atlanta to Maine. And it closed JFK airport for a short period of time. (As one who is in Virginia in an old river cottage 8 feet above the ground, the cautious JFK delay is understandable. Our cottage swayed right and left and the chair I was sitting in started tap dancing. It was like a simulator ride at one of the theme parks, only it was real.)

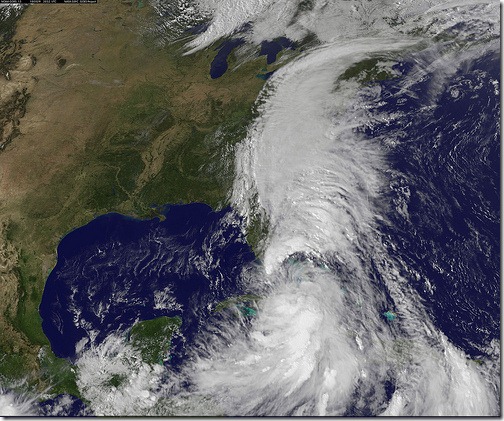

Now, Hurricane Irene is in the process of plowing through the Bahamas after visiting its destruction on the Turks & Caicos as well as parts of the Dominican Republic. Based on the latest forecast, Irene will spend its next few days bordering the U.S. Atlantic coast with its final destination near Boston. Irene will close many of these airports, making it impossible to fly out.

Airlines are waiving rebooking fees for travelers where Irene caused havoc and made a decent vacation impossible.

Cruise ships, on the other hand, normally depart come hell or high water because of their high overhead. For one, they can’t be as tolerant because each vessel has hundreds, if not thousands, of waiters, stateroom staff, cooks and other crew most other cruisers never know about who receive their main income—not from the cruise line—but from the tips they receive from passengers. And, there are other factors.

Back to cruise insurance: Anyone booking a Bermuda, Bahamas or Caribbean cruise between Aug. 15-Oct. 15 is gambling they won’t have to worry about a tropical storm or hurricane. Cruises normally offer discounts during this time for a good reason.

Beyond seasonal weather problems, there always is the chance of accidents while on a cruise. In Greece, I once watched a family left behind at the cruise dock (they had been waiting for their luggage to be unloaded) because the father had decided to rent a scooter. He was an M.D., who probably thought he could handle any of the family’s medical problems. Normally, he would have been correct. Only, this time he was the problem.

All cruise lines offer their own insurance. Travel agents do, too. And there are other independent insurance companies, too. Many exclude “acts of god” which would include storms, volcanoes and earthquakes. None that I know of state you can cancel because your cruise ship changed its itinerary due to a storm.

Fortunately, more companies are offering the option of Cancel for Any Reason, and that would include your cruise ship deviating from its scheduled itinerary—but only if you know this in advance. Here are the normal requirements for Cancel for Any Reason.

To qualify for this coverage, typically you must buy the of insurance within two weeks after your booking or your first trip payment. This type of policy allows you to cancel your trip for any reason not on the list of “named perils or otherwise covered.”

To insure your trip, you must buy coverage for the cruise’s full pre-paid price. Also, to cancel a trip for a reason that is “not otherwise covered” or in the list of “named perils” you must cancel at least 2 or 3 days prior to departure.

Cancel for any Reason could require a “co-payment” on your part covering between 10 to 50 per cent of your trip cost, depending on the plan. Or the policy could require none. That’s why you truly need to read the fine print when considering any policy.

A web site I like is one not sponsored by a travel insurance provider. To rely on one insurance company to compare the policies of its competition for you seems like inviting the fox into the hen house.

With over 50 plans from leading insurers to choose from, QuoteWright was voted “Best of the Web” by The Washington Post for its quality comparisons. In their comparison of Cancel for Any Reason policies from different companies, the links spell out whether the coverage is 100% or 50%, which helps to cut down the time needed to study coverage and policy prices.

In addition, don’t overlook the coverage that you may already have through the credit card you used to book and pay for your cruise. You did use a credit card and not a debit card or a check, right?

Follow

Follow